US tariffs: Ignore the noise, the media tech industry is tariff-resistant

Recent uncertainty around US tariffs on imported goods have caused concern across various industries trying to understand the potential impact on pricing and supply chains. However, a closer examination suggests that the media tech industry is relatively protected from any imposition of US or Chinese tariffs and we expect limited disruption to media tech supply chains.

Media tech industry and US tariffs: Minimal impact expected

As of now, the majority of previously announced tariffs have been paused for 90 days in favor of a flat 10% for most of the world, with the exception of newly-adjusted 125% tariffs on China, further devolving into a trade war between the world’s two largest economies. This further disadvantages Chinese-built hardware while softening the broader impact on US buyers across the supply chains in North America, Europe and the rest of Asia.

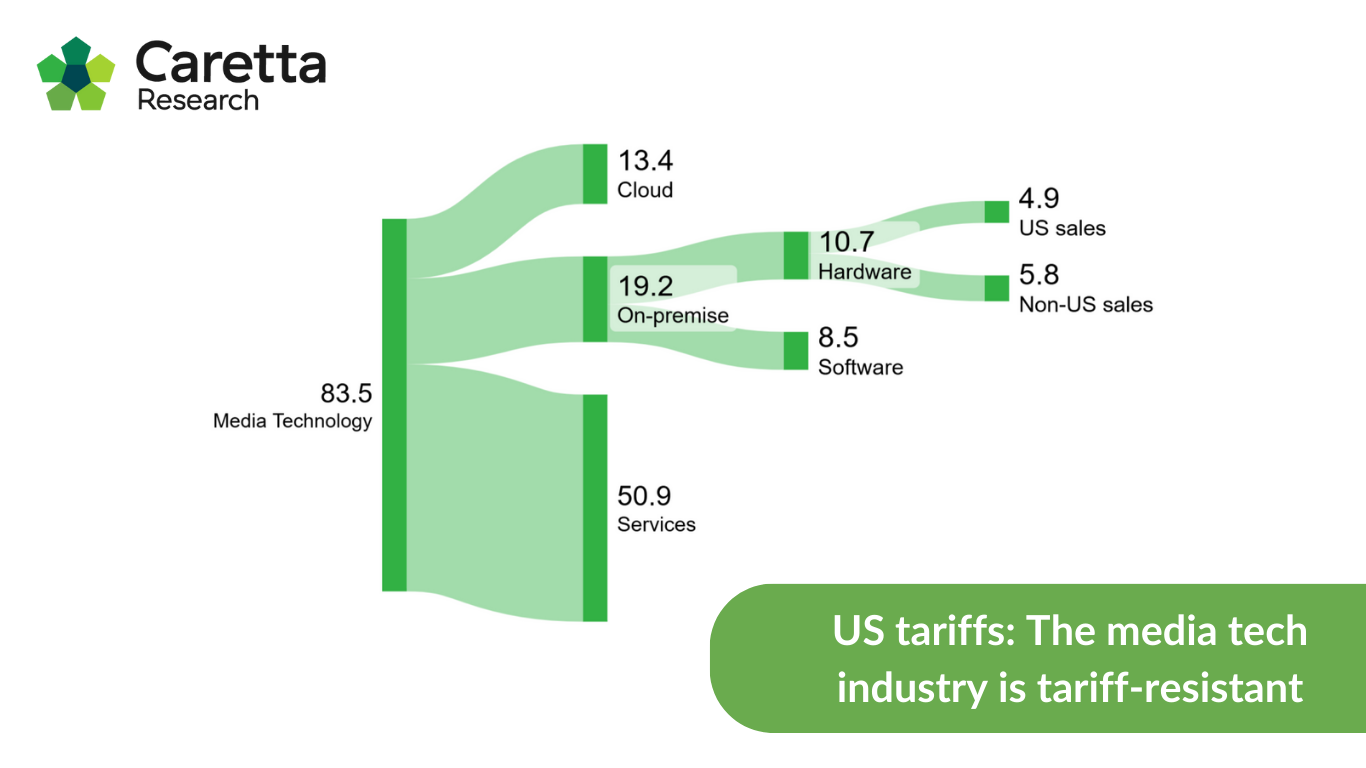

However, the impact of tariffs will be relatively narrow in Media Tech – the vast majority of the market is already sold as managed and professional services, cloud compute, SaaS and software, with hardware only making up 13% of the total $84B market.

While some media tech vendors might face challenges due to shifting global trade dynamics, the industry’s overall resilience is strong. Therefore, the media tech industry is well-positioned to navigate the disruptions caused by US tariffs or other global tariffs. While tariffs might affect industries like cars, pharmaceuticals and steel, they are largely insignificant in advanced information and digital sectors where the transition to software, SaaS and services is nearly complete.

Media tech market analysis: On-premise vs. cloud

Currently, over $19B worth of media technology is deployed on-premise, encompassing both hardware and packaged software. This represents a substantial portion of the $84B total market, which includes services, cloud and product sales. Of this $19B, approximately $11B is hardware, including encoders, switchers, cameras and transmitters, much of which is manufactured outside the US. With the US receiving nearly $5B in media tech hardware sales, the new tariffs, and accounting for 10% global tariffs and 125% tariffs on Chinese imports, this could add $1-2B in costs for US buyers.

Why does this matter? There are three sides to this – the impact on vendors, changes in technology and the impact on media tech buyers.

NAB Show 2025 insights: US tariff impact on media tech vendors

The immediate impact of these tariffs will likely be felt by vendors. US-based vendors manufacturing domestically might see a temporary boost, but potential retaliatory tariffs from other global markets could offset this advantage. Vendors importing products into the US, especially from China and Europe, will face increased costs and reduced competitiveness.

Feedback from NAB 2025 suggests that most US and European vendors are relatively relaxed about tariffs as the market isn’t very price sensitive, and products already have sizable margins baked in which can flex to absorb some of the cost to US buyers. However, it’s also worth considering that high-end European products might become relatively more affordable compared to Chinese-manufactured goods (whether from Chinese firms or US vendors). Either way, we’re likely to see the initial impact filtering through channel partners as resellers, distributors and integrators bear the initial risk and cost increases.

Media tech innovation: Adapting to tariffs through software and cloud

Tariffs could act as a catalyst for change, similar to the Covid-19 pandemic. Non-US vendors may pivot towards SaaS solutions and software licensing, bypassing tariffs by focusing on intangible services. This shift will increase the demand for commodity off-the-shelf (COTS) servers to run high-end software, reducing overall hardware costs. While this might not apply to specialised hardware for content capture or live production, decoupling hardware from software could become more common, even for cameras.

Impact of tariffs on media tech buyers: Pay TV, broadcasters and creators

Pay TV operators will see increased prices for set-top boxes and consumer premise equipment, as manufacturing is predominantly in China. While alternative manufacturing locations exist, switching or building new factories might not be cost-effective. This situation could accelerate the decline of traditional set-top boxes and increase reliance on smart TV vendors.

Content creators and broadcasters might see impacts at the lower end of the market. Larger creators already focus on services, with hardware being a smaller portion of their costs. Increased hardware import costs might push them towards cheaper alternatives, such as portable cameras from Blackmagic, DJI and Red, as well as software switching and cloud production tools. If dedicated hardware becomes significantly more expensive, using commodity servers with necessary software will become a viable option.